RESPA: Model Forms & Clauses

Table of Contents

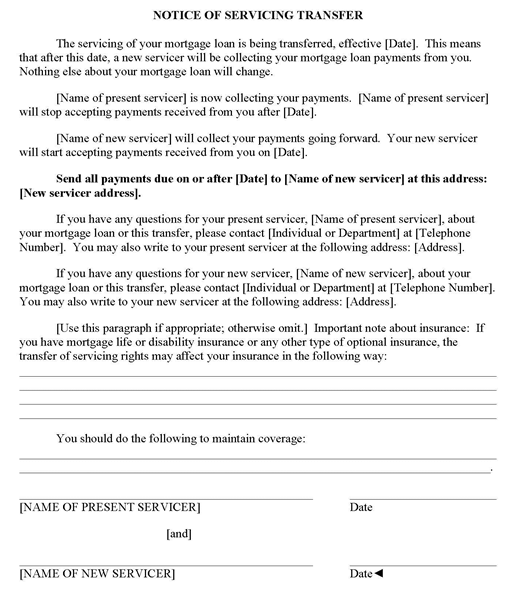

MS-2 – Notice of Servicing Transfer

MS-3(A) – Model Form for Force-Placed Insurance Notice Required Pursuant to § 1024.37(c)(2)

MS-3(B) – Model Form for Force-Placed Insurance Notice Pursuant to § 1024.37(d)(2)(i)

MS-3(C) – Model Form for Force-Placed Insurance NoticePursuant to § 1024.37(d)(2)(ii)

MS-4(A)—Statement Encouraging the Borrower to Contact the Servicer (§ 1024.39(b)(2)(i) and (ii))

MS-4(B)—Available Loss Mitigation Options (§ 1024.39(b)(2)(iii))

MS-4(C)—Additional Information About Loss Mitigation Options (§ 1024.39(b)(2)(iv))

MS-4(D)—Foreclosure Statement (§ 1024.39(b)(2)(v))

MS-4(E)—State Housing Finance Authorities and Housing Counselors (§ 1024.39(b)(2)(vi))

MS-3(A) – Model Form for Force-Placed Insurance Notice Required Pursuant to § 1024.37(c)(2

[Name and Mailing Address of Servicer]

[Date of Notice]

[Borrower’s Name]

[Borrower’s Mailing Address]

Subject: Please provide insurance information for [Property Address]

Dear [Borrower’s Name]:

Our records show that your [hazard] [Insurance Type] insurance [is expiring] [expired], and we do not have evidence that you have obtained new coverage. Because [hazard] [Insurance Type] insurance is required on your property, [we bought insurance for your property] [we plan to buy insurance for your property]. You must pay us for any period during which the insurance we buy is in effect but you do not have insurance.

You should immediately provide us with your insurance policy number and the name, mailing address and phone number of your insurance company or insurance agent. [Describe how the borrower may provide the insurance information]. [The information must be provided in writing.]

The insurance we [bought] [buy]:

- [Costs $[premium charge]] [Will cost an estimated $[premium charge]] annually, which is probably more expensive than insurance you can buy yourself.

- May not provide as much coverage as insurance policy you buy yourself.

If you have any questions, please contact us at [telephone number].

MS-3(B) – Model Form for Force-Placed Insurance Notice Pursuant to § 1024.37(d)(2)(i))

[Name and Mailing Address of Servicer]

[Date of Notice]

[Borrower’s Name]

[Borrower’s Mailing Address]

Subject: Second and final notice – please provide insurance information for [Property Address]

Dear [Borrower’s Name]:

This is your second and final notice that our records show that your [hazard] [Insurance Type] insurance [is expiring] [expired], and we do not have evidence that you have obtained new coverage. Because [hazard] [Insurance Type] insurance is required on your property, [we bought insurance for your property] [we plan to buy insurance for your property]. You must pay us for any period during which the insurance we buy is in effect but you do not have insurance.

You should immediately provide us with your insurance policy number and the name, mailing address and phone number of your insurance company or insurance agent. [Describe how the borrower may provide the insurance information]. [The information must be provided in writing.]

The insurance we [bought] [buy]:

- [Costs $[premium charge]] [Will cost an estimated $[premium charge]] annually, which is probably more expensive than insurance you can buy yourself.

- May not provide as much coverage as insurance policy you buy yourself.

If you have any questions, please contact us at [telephone number].

MS-3(C) – Model Form for Force-Placed Insurance Notice Pursuant to § § 1024.37(d)(2)(ii)

[Name and Mailing Address of Servicer]

[Date of Notice]

[Borrower’s Name]

[Borrower’s Mailing Address]

Subject: Second and final notice – please provide insurance information for [Property Address]

Dear [Borrower’s Name]:

We received the insurance information you provided but we are unable to verify coverage from [Date Range].

Please provide us with insurance information for [Date Range] immediately.

We will charge you for insurance we [bought] [plan to buy] for [Date Range] unless we can verify that you have insurance coverage for [Date Range].

If you have any questions, please contact us at [telephone number].

MS-3(D) – Model Form for renewal or Replacement of Force-Placed Insurance Notice

[Name and Mailing Address of Servicer]

[Date of Notice]

[Borrower’s Name]

[Borrower’s Mailing Address]

Subject: Please update insurance information for [Property Address]

Dear [Borrower’s Name]:

Because we did not have evidence that you had [hazard] [Insurance Type] insurance on the property listed above, we bought insurance on your property and added the cost to your mortgage loan account.

The policy that we bought [expired] [is scheduled to expire]. Because [hazard][Insurance Type] insurance] is required on your property, we have the right to maintain insurance on your property by renewing or replacing the insurance we bought.

The insurance we buy:

- [Costs $[premium charge]] [Will cost an estimated $[premium charge]], which is probably more expensive than insurance you can buy yourself.

- May not provide as much coverage as an insurance policy you buy yourself.

If you buy [hazard] [Insurance Type] insurance, you should immediately provide us with your insurance policy number and the name, mailing address and phone number of your insurance company or insurance agent. [Describe how the borrower may provide the insurance information]. [The information must be provided in writing.]

If you have any questions, please contact us at [telephone number].◄

MS-4(A)—Statement Encouraging the Borrower to Contact the Servicer (§ 1024.39(b)(2)(i) and (ii))

Please contact us. [We may be able to make your mortgage more affordable. The longer you wait, or the further you fall behind on your payments, the harder it will be to find a solution.]

[Servicer Name]

[Servicer Address]

[Servicer Telephone Number]

[For more information, visit [Servicer Web Site or Email Address]].

MS-4(B)—Available Loss Mitigation Options (§ 1024.39(b)(2)(iii))

[You may have options that could help make your mortgage more affordable, including:]

[Forbearance. This is a temporary reduction or suspension of your mortgage payments. Forbearance might be available if recent events have made it difficult for you to make your payments—for example, if you recently lost your job, suffered from a disaster, or had an illness or injury that increased your health care costs. If this option is available, your lender could create a payment plan to make up any missed payments over a period of time.]

[Mortgage modification. Your lender may be able to change your loan terms, such as your interest rate, the amount of principal you owe, or the number of years you have to repay the loan.]

[If you are not able to continue paying your mortgage, your best option may be to find more affordable housing. As an alternative to foreclosure, you might be able to transfer ownership of your home without having to pay off the full amount of your mortgage, although you would be required to leave your home. For example, you may be eligible for the following option[s]:]

- [Short-sale. With your lender’s permission, you might be able to sell your home and pay off your mortgage even if the sale price is less than your remaining balance. You might also be eligible to receive money to help you move.]

- [Deed-in-lieu of foreclosure. Your lender may release you from your mortgage if you transfer ownership of your home to your lender. As with a short sale, you might also be eligible to receive money to help you move.]

MS-4(C)—Additional Information About Loss Mitigation Options (§ 1024.39(b)(2)(iv))

[Call us today to learn more about your options and for instructions on how to apply.]

MS-4(D)—Foreclosure Statement (§ 1024.39(b)(2)(v))

Foreclosure is a legal process a lender can use to take ownership of a property from a borrower who is behind on his or her mortgage payments. The foreclosure process usually begins approximately [_] days after you miss a mortgage payment, although it may begin earlier or later. The foreclosure process depends on the laws of the state where your home is located, the terms of your loan, whether you are covered by the Servicemembers Civil Relief Act, and other factors.

MS-4(E)—State Housing Finance Authorities and Housing Counselors (§ 1024.39(b)(2)(vi))

For help exploring your options, Federal government agencies provide contact information for housing counselors, which you can access by contacting [the Consumer Financial Protection Bureau at [Bureau Housing Counselor List Telephone Number] or [Bureau Housing Counselor List Web Site]] [the Department of Housing and Urban Development at [HUD Housing Counselor List Telephone Number] or [HUD Housing Counselor List Web Site]].

Your State housing finance authority may also be able to help. You can reach them at [State Housing Finance Authority Telephone Number] or [State Housing Finance Authority Web Site].